Home - SAP for Insurance : how do the modules work together?

SAP for Insurance: how do the modules work together?

Milan Plavsic

Digital transformation is becoming a necessity for companies in various industries. But more specifically, what does SAP for Insurance offer insurers? How do the modules communicate with each other and how does it all fit into SAP’s S/4HANA landscape?

SAP for Insurance Architecture

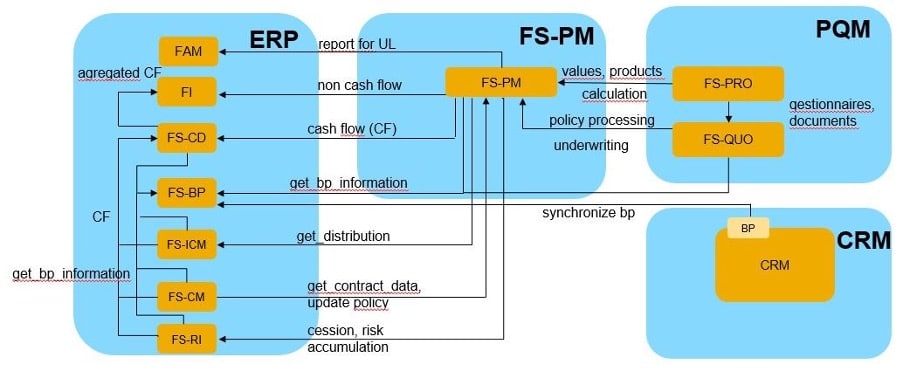

At first, let’s take a closer look at the key modules that are incorporated within SAP for Insurance. Below is the diagram of SAP for Insurance architecture with core modules highlighted in green.

Key modules of SAP for Insurance offer below functionalities:

Product Management Component

This component is used to create customized insurance products and it’s corresponding formulas and rules. Sometimes it is referred to as the calculation engine, since it is called during runtime to calculate various data on the insurance policy.

Here we have two distinctive solutions offered as standard tools from SAP:

- msg.PM – Msg.Product Manager: introduced at first as the only calculation engine, msg.PM has two components: PM.Designer (this component is used to develop, manage and test insurance product data) and PM.Runtime (this is a runtime component that delivers product data and once called it executes insurance calculations).

- FS-PRO – SAP Product Lifecycle Management for Insurance : it was introduced mainly as a go-to solution for P&C and Auto lines of business (though msg.PM can also handle those LOBs besides Life and Pension insurance). The main component of FS-PRO is Insurance Product Configurator. Insurance Product Configurator consist of three main parts: Administrative Console (component that handles management of system, application and user profiles), the Product Configurator (main component which is used for development and management of a portfolio of insurance products) and the Product Web Services (connectivity component that enables use of product data to other components in the SAP for Insurance landscape).

Deciding whether to use msg.PM or FS-PRO depends on particular business requirements and should be determined per insurer

FS-QUO – SAP Quotation and Underwriting for Insurance

This module is used for making insurance quotes and handling underwriting processes (together with FS-PRO). Some of the key features of FS-QUO include:

- Create an insurance quote – Either full quote or quick quote with only partial information.

- Simulate underwriting – Check underwriting rules and decision by running a simulation.

- Submit a quote for underwriting – Execute underwriting tasks on a quote to get an underwriting decision.

- Manage quote options – Compare quotes, assign and reassign quotes, delete a quote, create tasks for the quote, etc.

- Request Cash Before Cover payment

- Issue a policy from a particular quote

FS-PM

With FS-PM insurers can handle their entire policy life-cycle. As it represents the heart of SAP for Insurance software suite we are going to explain it in more detail. Some of the main functionalities include:

- New Business for creation of insurance policies;

- Inquiry for displaying various policy data;

- Change business process for executing any kind of changes on the policy. Standard delivery of business transactions include various Life, Non-Life and Auto business transactions;

- Universal Change process to correct any field on the policy (used mostly when Change business process business transactions are not available);

- Reversal business process to end the policy manually;

- Reset business process to revert any kind of changes that already happened on the policy;

- Renewal business process to renew the policies in bulk;

- Update business process to execute update of policies in bulk.

FS-CD

This is the central booking system for handling incoming and outgoing payments coming from FS-PM, FS-ICM and FS-CM. Some of its main functionalities include:

- Open item accounting

- Payment processing

- Dunning

- Interest calculation

- Broker collections

- Correspondence

FS-ICM

Very flexible Incentive and Commissions Management module which can be used to facilitate any broker and commission contract structures, rules and calculations. Together with FS-ICM, PFO module is used for Portfolio assignment.

Some of the main functionalites of FS-ICM are listed below:

- Serves as an incentivizing Salesforce tool to improve sales and gain more clients

- Maintenance of the legal commission contracts with brokers and agents

- Calculations of remunerations for any action in the system that requires that

- Settlement of commissions to the target settlement system

- The main functionality of PFO is to manage, assign and reassign relationships between insurance policies and commissions contracts

FS-CM

Is used to handle claims from notification to fulfillment and recovery. Main Processes within Claims Management are listed below:

- Claim Notification

- Claim Handling

- Claim Fulfillment

- Claim Recovery

FS-RI

It represents a complete Reinsurance solution from SAP. This module is integrated with primary insurance modules and some of its main functionalities include:

- Contract Administration

- Management of Assumed, Ceded and Retroceded treaties

- Reinsurance Accounting

- Reinsurance Claims Processing

- Financial Reporting

Integration between SAP for Insurance modules

This solution is delivered with a predefined set of standard products which can be used to create sample policies and show sample flows in the system, so-called Sample Content. It’s possible to enable integration within SAP for Insurance with little configuration and immediately see the results by trying out some of the Sample Content data.

When looking at the separate modules, the heart of SAP for Insurance suite is FS-PM. This policy administration component is responsible for triggering most of the connection points between separate modules.

At first, during design time, Product Management components (whether msg.PM or FS-PRO) import part of the product structure to FS-PM. Sales product from product management components can be seen as a template based on which insurance policies are created. Therefore, insurance policy in FS-PM represents one instance of a Sales product designed in either of product management components.

During runtime, this insurance policy in FS-PM calls product management component to calculate premium, sum insured and other calculation-relevant data. This is realized by FS-PM aggregating and sending relevant data to the product management component which in turn uses this data, calculate the results and sends it back to FS-PM.

This type of integration is possible on every change on policy in FS-PM throughout the policy life-cycle. Once the insurance policy is properly calculated and the process is about to be completed, FS-PM calls other interfaces and sends them relevant data.

FS-PM aggregates commission relevant data and sends it to FS-ICM. FS-ICM will trigger FS-CD to create a payment for the commission. The same applies with FS-PM to FS-CD interface, where FS-PM creates all cashflows and sends them to FS-CD. In case a claim happens, FS-CM will call FS-PM to request policy data, so-called policy snapshot. In that case, FS-CM will call in-built functionality in FS-PM to collect relevant insurance policy data which is needed further for claim creation and processing. Once the claim is processed, FS-CM will call FS-CD to create an outgoing payment to reimburse the beneficiary for the loss that occurred.

When it comes to integration with other SAP S/4HANA modules, SAP for Insurance uses BP (Business Partner) data for all it’s participants. All FS modules have built-in functionalities to use data from BP module whether in the background or jump via the user interface to display relevant participant and its data. Non-cashflow documents are sent to FI-GL (General Ledger Accounting), while cashflows are sent to FS-CD.

CRM uses BP data and can trigger quotations via FS-QUO. Reporting requirements are realized by extracting data from FS modules via data extractors and by transferring it to BW to be used as a basis for reporting.

Le CRM utilise les données BP et peut déclencher des cotations via FS-QUO. Les exigences en matière de reporting sont réalisées en extrayant les données des modules FS via des extracteurs de données et en les transférant à BW pour servir de base au reporting.

All in all, this was just a brief introduction to SAP for Insurance and its main functionalities. SAP’s software suite for the insurance industry definitely offers a wide range of functionalities for insurers of all sizes and all lines of business and as such it is one of the most complete insurance solutions on the market. If you want to learn more about SAP for Insurance, please contact us, our experts will give you more precisions.

- S4IC is the commercial name of High-SEA company

- Open from Monday to Friday - 9am to 6pm

- Avenue Voltaire 3, 1300 Wavre

- +32 (0)2 880 91 10

- info@s4ic.com

- VAT : 0806 380 893

Copyright S4IC – 2021